The Buzz on $255 Payday Loans Online Same Day

Table of Contents9 Easy Facts About $255 Payday Loans Online Same Day ExplainedOur $255 Payday Loans Online Same Day IdeasNot known Details About $255 Payday Loans Online Same Day Top Guidelines Of $255 Payday Loans Online Same DayThe smart Trick of $255 Payday Loans Online Same Day That Nobody is Discussing

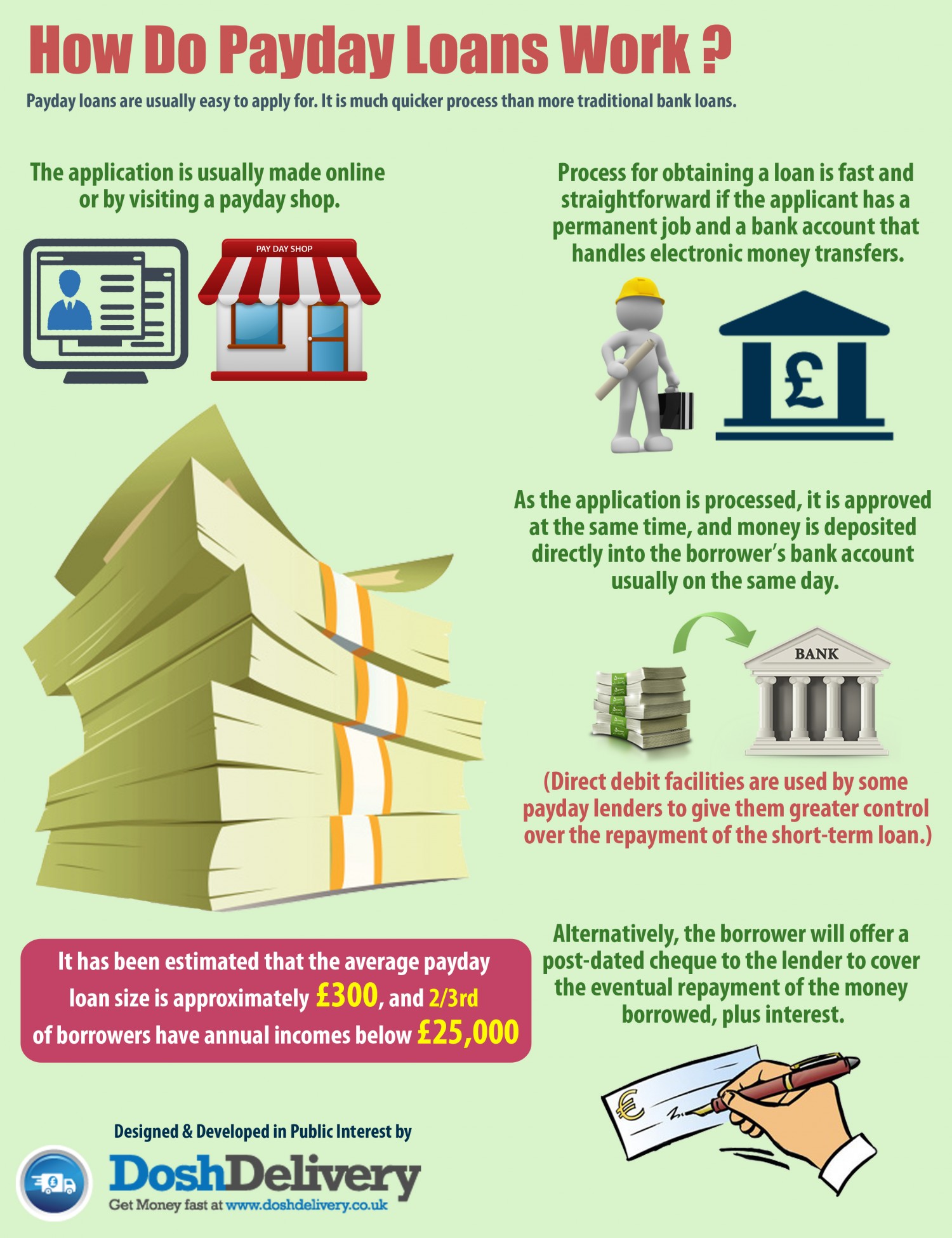

If you're thinking about a payday car loan, after that you may wish to look first at safer personal financing alternatives. Payday lending suppliers will generally require you to reveal proof of your incomeusually your pay stubs from your employer. They will after that offer you a portion of the money that you will be paid.Cash advance lenders take on a great deal of threat, due to the fact that they do not examine your capability to pay back the car loan. Due to this, they usually bill extremely high passion rates for payday advance loan, and they may also charge high fees if you miss your repayments. This can be hazardous for borrowers since it can indicate that you'll need to obtain more cash to cover the cost of the first financing.

, you need to normally give pay stubs from your company that show your current level of revenue. Numerous additionally make use of a borrower's earnings as collateral.

The smart Trick of $255 Payday Loans Online Same Day That Nobody is Talking About

In the United States, as of 2022, 16 states and the Area of Columbia have actually prohibited payday fundings. Investopedia/ Michela Buttignol Payday lenders charge really high degrees of interest: as much as 780% in annual portion price (APR), with an average finance running at almost 400%.

As these lendings get numerous state lending technicalities, debtors ought to be cautious. Rules on these finances are regulated by the specific states, with 16 states, Arizona, Arkansas, Colorado, Connecticut, Georgia, Maryland, Massachusetts, Montana, New Hampshire, New Jersey, New York City, North Carolina, Pennsylvania, South Dakota, Vermont, as well as West Virginiaand the Area of Columbia banning payday loans of any type of kind.

Financing costs on these fundings also are a considerable factor to take into consideration, as the typical fee is $15 per $100 of lending. Although the federal Truth in Borrowing Act needs cash advance loan providers to divulge their finance costs, many individuals neglect the expenses. Most loans are for 30 days or less and assist customers to fulfill short-term responsibilities.

The Only Guide to $255 Payday Loans Online Same Day

The policies additionally required loan providers to give written notice before attempting to gather from a borrower's savings account and further needed that after 2 not successful attempts to debit an account, the lending institution might not try once again without the authorization of the consumer. These rules were very first proposed in 2016 and also under the Biden Management, the brand-new management at the CFPB developed stricter guidelines for cash advance lending, which came to be compulsory on June 13, 2022.

Kraningerissued proposed regulations to withdraw the required underwriting provision as well as delay execution of the 2017 policies. $255 Payday loans online same day. In June 2019, the CFPB provided a final guideline postponing the August 2019 compliance date, as well as on July 7, 2020, it provided a final rule revoking the necessary underwriting stipulation however leaving in position the constraint of duplicated efforts by payday lending institutions to accumulate from a borrower's savings account.

Lots of payday lending institutions don't also share their fees as an interest rate, but they rather bill a fixed flat charge that can be anywhere from $10 to $30 per $100 obtained. The majority of payday financings are unsecured.

The Ultimate Guide To $255 Payday Loans Online Same Day

The lending institution may ask you to visit site write a check for the payment quantity, which the lender will certainly cash when the car loan is due. Under federal legislation, lending institutions can not condition a cash advance financing on obtaining an authorization from the customer for "preauthorized" (persisting) electronic fund transfers.

The cash advance finance might be filed once it is passed to the collectors after the lending institution sells the debts. If you repay your payday loan on time, after that your credit scores score shouldn't be affected.

This is because cash advance loan providers make considerable amounts from the passion that they bill on these financings. This means that you need to attempt and also settle payday lendings as quickly as you potentially can. If you link can't repay a cash advance funding, the account may be sent to a collection agency, which will certainly seek you for the cash as well as interest that you owe.

Some Known Details About $255 Payday Loans Online Same Day

Yes. Having a savings account isn't globally called for to obtain money, yet lending institutions that do not need it generally charge high rate of interest. This consists of several payday lending institutions. Payday loan providers may request a savings account, however in some cases a prepaid card account may be enough to certify. Since these loans set you back so much and may be hard to settle, it's usually ideal to avoid them - $255 Payday loans online same day.

:max_bytes(150000):strip_icc()/Pay-Day-Loan-Personal-Loan-dfdeaa22f6ea4790b1c966fcd6c937cf.jpg)

Due to the fact that of this, you must just obtain a cash advance if you are definitely certain that you can pay it back. Payday fundings are developed to cover temporary expenses, and also they can be taken out without security and even a savings account. The catch is that More Info these car loans bill extremely high charges as well as rate of interest rates.